When you try to find some information about futures spread trading around the Internet, you will probably notice that it’s not so easy to find relevant information. Spread in connection with trading covers several different topics. Bid/ask spread, spread betting, options spreads etc. with futures spreads being probably the least popular. Once you find sources of desired information, you realize that many of them start with the claim that futures spread trading is the best kept secret in trading, hidden from public for years or traded only by professionals and so on. The worst sales clichés, if you ask me. On the other side, the truth is that futures spread trading is one of the least popular trading styles, and I would say its share compared to the other styles is practically neglectable.

Spread trade is the simultaneous purchase of one security and sale of a related security, called legs, as one unit. Opening spread trade, we are in long and short position. Why is that useful? There are several applications depending on intentions and traded security. Let’s see some of them.

The most known application is to create hedge and reduce your systematic risk (the risk inherent to the entire market or entire market segment, also known as un-diversifiable or market risk). During the times of market turbulences, you may want to be market-neutral and protected against the fall of markets. For example, imagine yourself being long Goldman Sachs stock during the financial crisis and you are unsure about the future. You consider Goldman as the strongest bank and Bear Stearns the weakest on the Wall Street. However, as the banking system is in trouble, no matter how good Goldman is, stock price will fall with the rest of the market. So you can add short Bear Stearns position and lower your risk. You are not depending on market conditions, your only concern is the performance between Goldman and Bear Stearns, which should be in favor of Goldman because of being the stronger one. Similar way we can trade indexes. Let’s say you think that the U.S. economy is at the beginning of a recovery and growth period and then smaller companies should grow faster than large companies (in terms of percentage). You can trade this opportunity by buying small cap index e.g. IWM (ETF Russell 2000) and selling large cap index e.g. DIA (ETF Dow Jones Industrial Average). And vice versa, in times of economic recession, large caps should outperform small caps, so you should swap legs in your spread.

Speaking about stocks, another strategy is stock pair trading (terms pair trading and spread trading are synonyms), market neutral strategy exploiting short-time market inefficiencies. Choose two long-term high correlating stocks of the same sector and their ratio of prices will oscillate around the average value. In case of inefficiency (for whatever reason ratio comes outside the standard area), you can enter high probability success speculation that ratio will return back to the average value. By opening long and short position you are, like in the previous example, hedged against the systematic risk. The problem with stocks pairs trading is that stocks are not easy to short, we have to pay interest on borrowed shares and if you are short during a dividend, you have to pay it. And also you should have a big enough account as you need to trade always two shares in pair and there’s not much leverage trading stocks (compared to futures).

We could go on with examples and talk about options spreads (there is almost an infinite number of options strategies) or commercials hedging (for example, producers own physical vehicle and use short futures to create spread and protect against risk) and so on, but this is out of scope of this article. We will focus now on futures spreads and seasonality.

We already know that spread is created by entering long and short position simultaneously. But trading futures, we can make various spread combinations:

Trading futures spreads has numerous advantages as we will explain in next few sections.

First of all, we are trading futures and this means leverage. If you invest into stock, you need to pay 100% of their value. Being a speculator in stocks, you can use some margin and pay only 50% of underlying value. But futures are traded with high leverage. To buy or sell futures contract, you typically need only a margin of 3-10% of the contract value. When you pay a 3% margin and markets move in your favor 3%, then you doubled your margin money. But the leverage is of course adouble- edged sword and as quickly you can make money, you can usually lose it even much quicker. Same as with fire, leverage is a good servant but a bad master. Proper money management, and I can’t stress this enough, is the must and the most important part of your trading, if you want to survive and stay in trading business.

Trading futures spreads instead of outright position brings margin reduction. For example, when you are long August Crude Oil, your margin is around 2500$. Short May Crude Oil requires margin around 3000$. But when you create spread Long August Crude Oil - Short May Crude Oil, the margin doesn’t sums up to 5500$. Spread margin is only 500$, about a 90% reduction. Why? Futures spreads are usually not as volatile as outright naked positions. The exchanges and brokers recognize that spreads carry less risk and therefore reduce margin requirements. Another reason is fewer factors involved in the trade. Being long Crude Oil means you have also exposure to the USD (represents the whole US economy) which can bring events that are impossible to predict or account for. When you create a spread, you are hedging out the USD and other outside market effects and trading only the specific market.

Required margin depends on spread and its recognition by an exchange. Intracommodity spreads have the lowest margin, Intercommodity spreads margin is usually higher and for some more exotic spreads reduced margin doesn’t exits, then you have to pay combined margin for both legs. You have to be very careful, because with reduced margin, you can very easily overtrade your account. On the other hand, reduced margin allows you to greatly diversify your portfolio. Always check margin requirements with your broker.

Spreading offers an opportunity to trade markets with less capital than outright futures position and be hedged at the same time.

Spread trader makes profit from a change in the price differential between two futures contracts. This relationship can change, even when underlying markets don’t move. The overall direction of futures prices is not the main consideration. Price direction should be a part of a successful spread analysis, but the prime is the direction in the movement of the spread. In the other words, is the spread narrowing or widening? For example, consider grains market being in the range. Wheat is ranging between 8$ to 8.50$ and corn between 7.25$ to 7.75$. In case that wheat rises to the top of the range and corn falls to the bottom, spread potential to move is 1$. Favorable moves of the spread are show in table below:

| Long contract | Short contract |

|---|---|

| Rises faster | Rises slower |

| Rises | Remains flat |

| Remains flat | Falls |

| Falls slower | Falls faster |

| Rises | Falls |

Of course, spread will be losing on any of opposite possibilities. It’s important to realize that spread can harm you more than outright futures position. When a long contract falls and short rises, you are losing on both legs. But this doesn’t happen very often, and usually in combinations of less conservative spreads and the big fundamental news (for example inter crop spreads and unfavorable grains reports). Intracommodity spreads can also protect you against the lock limit moves (we will cover this topic in another article).

So spreads trend usually more often than outright futures, but other opportunities lie in the number of combinations of spread. As we explained earlier, we can combine different delivery months, commodities and even exchanges. These possibilities are nearly limitless.

Spreads also allow you to trade inverted markets. Inverted market has nearer month selling at price premiums to the deferred month. This usually occurs when a commodity is currently in short supply, which in the short term pushes prices up. In inverted market, you have two ways to profit. When price starts to invert, and again when price returns to a common continuance.

Futures spreads do not have stops. They are not accepted at the exchange. Stop exists in the spread differential and can be calculated by a combination of any number of futures prices. When you are in a spread, you have no exit order in either market (long and short legs). Your trade is anonymous, nobody has an idea what your true position or intent are. No stops means no stop running and you are also more protected against intraday noise. It has probably happened to you many times that some event on the other side of the globe moved the market up or down and stopped your position. You can be correct with the bullish trend in Crude Oil, but a big decline in the Japanese Stock market during the night can stop your position, watching only later Crude Oil rising again.

There are other advantages:

Of course nothing is perfect and you need to know also the dark side of the spreads:

The base of our trading is seasonality. And there’s no better symbiosis than seasonality and spreads. As we have seen examples of seasonality in the previous article, I’m going to show you examples of seasonality in spread trading.

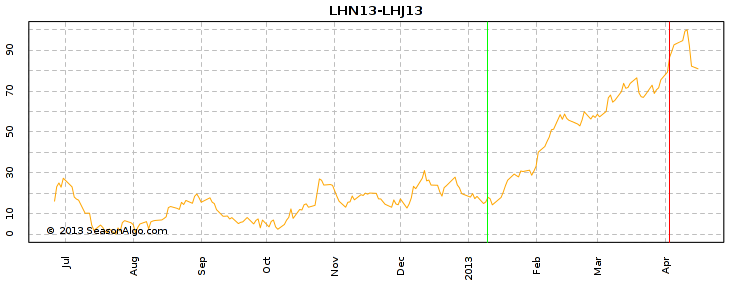

Demand for Lean Hogs increases during warmer months, so prices for the back month usually have premium price over the front month as the the US consumes more lean meat over summer. We can create spread by buying July Lean Hogs and selling April Lean Hogs. Computer optimized window starts on January 10 and ends on April 3. Such a strategy without any additional tweaks has a 90% win probability with 1170$ average profit.

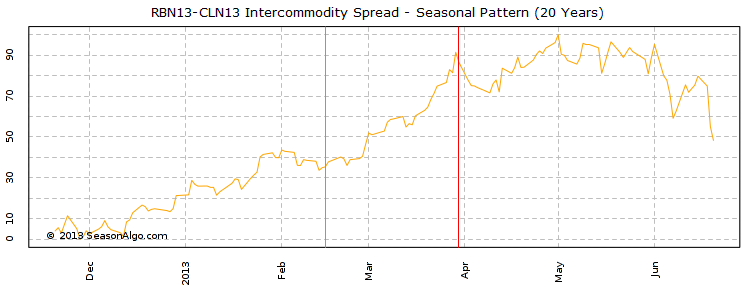

When winter is coming to its end and thaw opens the roads, rivers and seaways used for delivery, Crude Oil supplies start to build. As the weather gets better and snow melts, Heating Oil usually starts to decline, helping to build Crude Oil stocks. Traffic on roads rises which means increasing demand for Gasoline. We can create spread by buying July RBOB Gasoline and selling July Crude Oil. Computer optimized window starts on February 15 and ends on March 30. Such a strategy without any additional tweaks has a 95% win probability with 1245$ average profit.

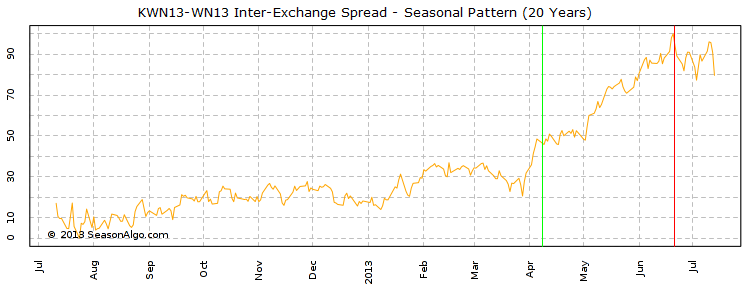

The last example is Inter-Exchange spread. You should be aware of their higher volatility and margin requirements. Chicago trades Soft red winter wheat and Kansas City trades Hard red winter wheat. The different wheats have different uses and are difficult to substitute one for the other. Hard red winter wheat is used primarily for export, Soft red wheat is used domestically. Differences between these two classes of winter wheat usually move spreads between them. Hard red grows in regions with more unstable weather, which explains the tendency of Hard red to outperform Soft red from the beginning in April into the end of harvest in June. We can create spread by buying July KCBT Wheat and selling July CBOT Wheat. Computer optimized window starts on April 8 and ends on June 21. Such a strategy without any additional tweaks has a 90% win probability with 470$ average profit.

Trading spread allows you to reduce risks in futures position. In times like these, European countries having troubles with their sovereign debts and the US faring not much better with their own economy, no one knows what will come next and Greece was probably just the beginning. Futures spread can help you to protect yourself against outside market events. There is almost an infinite number of trading opportunities mainly based on seasonality edge. Spreads being the price differential between two futures contracts, no one knows your trading intentions a stops. But always follow your trading plan with proper money management, as it’s easy to overtrade your account with reduced margins, and watch your discipline to keep your mental stops.

The information presented in this site is for general information purposes only. Although every effort attempt has been made to assure accuracy, we assume no responsibility for errors or omissions. Everything is provided for illustrative purposes only and should not be construed as investment advice or strategy. This site disclaims any responsibility for losses incurred for market positions taken by visitors or registered users, or for any misunderstanding on the part of any users of this website. This site shall not be liable for any indirect incidental, special or consequential damages, and in no event will this site be held liable for any of the products or services offered through this website.

The risk of loss in trading commodities can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well for you. The use of leverage can lead to large losses as well as gains. Past results are not indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

© 2013, SeasonAlgo.com