For whatever reason, not everybody can or wants to become a day trader. I was one of them. Due to work from home and small kids around I was looking for alternatives. I found two - stock pair trading and commodity spread trading - and decided to have a go with both of them. I started with spreads.

Looking back at that time (a few years ago), I must say that contrary to my usual character, my preparation was quite thorough. I read and made notes about all commodities that I intended to trade. I created a Notebook in OneNote that contained brief descriptions with all the basic information. At that time I found only one good source with spread and seasonality charting capabilities (and by the way, it was not SeasonAlgo).

Equipped with a freshly opened account, new knowledge about commodities, completed basic training about spread trading and a few paper trades I dived into the thing and opened my first real spread trade.

To cut a long story short, after several spreads (Lean Hogs, Crude and Gasoline, Treasuries) I quitted. The emotional turmoil created by incorrectly chosen spreads and volatile equity curve was too much for me to bear. I did not want to give up, though, so I ventured into another not very widespread trading strategy called stock pair trading. And I have stuck to it ever since.

A couple of years later, after gaining some experience in handling stock pairs as well as my emotions during PnL swings (very modest in pair trading) I started to look for ways to compensate for occasional streak of not very successful trades during periods of earnings.

It was easy to come back to spreads. I searched online again in anticipation of growing popularity of this type of trading since my last attempts. And indeed, I found lots of talking. But no practical help. Then I stumbled upon an easy online charting tool on the SeasonAlgo website. Thanks to their anniversary, I was lucky enough to be able to use the tool for one complimentary month (March/April). On the other hand, it came so quickly that I was not able to prepare as thoroughly as last time. So I just based my new spread trades on my previous knowledge and worked the spreads on the go.

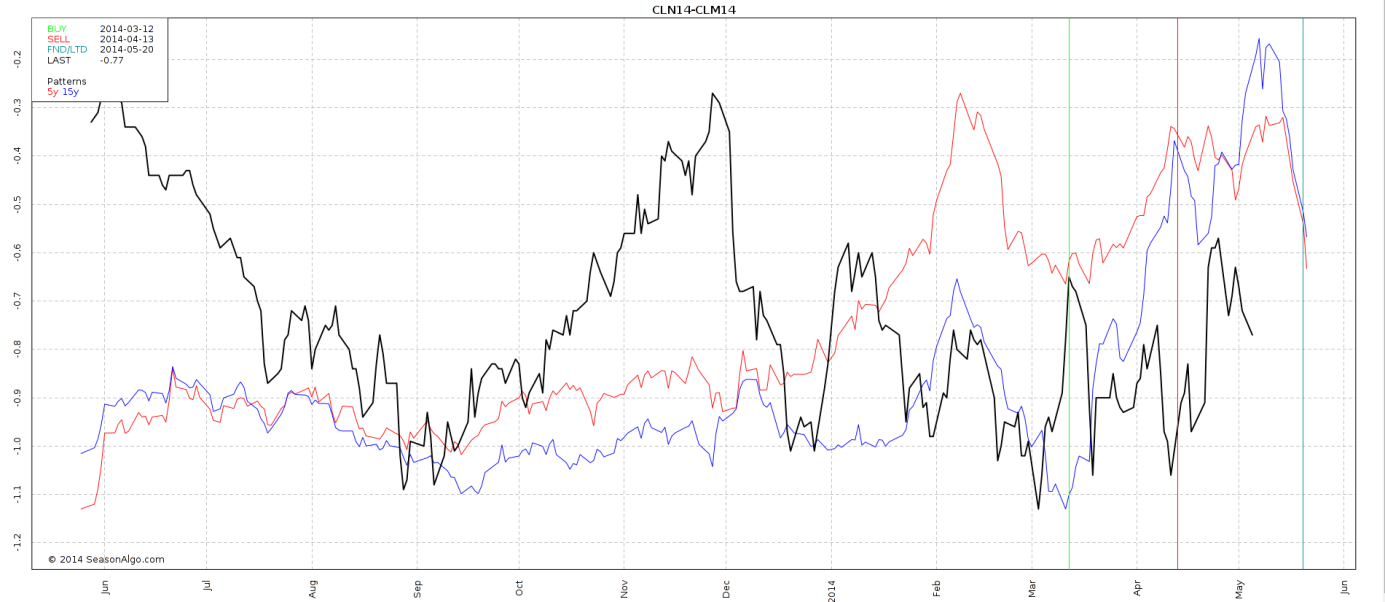

Due to my past experience I planned to avoid spreads with high swings. I cautiously selected three spreads with a potential of just a couple of hundreds USD. One of them was a spread in Crude Oil (CLN14-CLM14). I assessed the risk and its potential and decided to use my old strategy for entry.

The spread was already opened according to the SeasonAlgo strategy so after considering the trade, I bought 1 spread at -0,86 on March 26 after it created a Ross hook and looked promising. However, as it sometimes happens, the spread started to trade up and down and then aggressively against me. I had the spread planned and had my Stop Loss ready, however the feeling of loss is never nice. Because of that I was following the spread a bit more cautiously and I found out that not only on the daily chart but also during the day it traded in a channel. Because my plan allowed it and the spread confirmed it, I scaled in and bought another contract at -0,99 at the beginning of April. On the following day, the spread closed at the low (near my Stop Loss) and went up immediately afterwards reaching the target on the other side of the channel a few days afterwards. Had I followed the spread a bit more before, I would be prepared for the channel. However, I was a bit too impatient with opening it and had to manage the trade on the go.

And here is how it looks today:

To draw a conclusion from the sample trade, I have realized that I need to combine both my approach from the past as well as my newly acquired insights. I have also realized that even though spread trading is far distant from day trading, there are several principles that apply to both.

Here are my main findings:

There is much more to it. And that is the beauty of trading.

MATrader

The information presented in this site is for general information purposes only. Although every effort attempt has been made to assure accuracy, we assume no responsibility for errors or omissions. Everything is provided for illustrative purposes only and should not be construed as investment advice or strategy. This site disclaims any responsibility for losses incurred for market positions taken by visitors or registered users, or for any misunderstanding on the part of any users of this website. This site shall not be liable for any indirect incidental, special or consequential damages, and in no event will this site be held liable for any of the products or services offered through this website.

The risk of loss in trading commodities can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well for you. The use of leverage can lead to large losses as well as gains. Past results are not indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight.

© 2013, SeasonAlgo.com